Insurance coverage defense is one of those things which we often forget about until eventually we really need it. It is really the security Internet that will catch us when everyday living throws us a curveball. Regardless of whether it's a sudden clinical unexpected emergency, a car incident, or damage to your house, insurance coverage protection makes sure that you're not remaining stranded. But, just what does it mean to obtain insurance coverage defense? And just how Are you aware of when you are definitely coated? Let's dive into the world of insurance policy and explore its several aspects to assist you to understand why it's so critical.

Insured Solutions Things To Know Before You Buy

Initially, Allow’s take a look at what insurance coverage defense actually is. It’s effectively a deal amongst you and an insurance company that promises monetary guidance from the celebration of a loss, harm, or injuries. In exchange for a monthly or annual premium, the insurance provider agrees to cover selected risks that you could possibly face. This protection will give you relief, knowing that In the event the worst comes about, you won’t bear all the economic stress by yourself.

Initially, Allow’s take a look at what insurance coverage defense actually is. It’s effectively a deal amongst you and an insurance company that promises monetary guidance from the celebration of a loss, harm, or injuries. In exchange for a monthly or annual premium, the insurance provider agrees to cover selected risks that you could possibly face. This protection will give you relief, knowing that In the event the worst comes about, you won’t bear all the economic stress by yourself.Now, you may be imagining, "I’m healthier, I push cautiously, and my dwelling is in very good shape. Do I really need insurance plan safety?" The truth is, we can never predict the future. Mishaps happen, sickness strikes, and organic disasters manifest without the need of warning. Insurance protection acts to be a safeguard against these unforeseen events, supporting you regulate expenses when factors go Completely wrong. It’s an investment in the long run properly-currently being.

The most prevalent types of insurance defense is wellbeing coverage. It addresses clinical expenditures, from program checkups to crisis surgical procedures. Without the need of overall health insurance, even a brief healthcare facility keep could depart you with crippling medical payments. Wellness insurance allows you to entry the care you'll need without having stressing regarding the economical pressure. It’s a lifeline in moments of vulnerability.

Then, there’s car insurance policy, which is an additional critical style of protection. Irrespective of whether you might be driving a manufacturer-new car or truck or an more mature design, mishaps can materialize Anytime. With vehicle insurance, you might be protected while in the function of the crash, theft, or harm to your motor vehicle. As well as, if you are involved with a mishap where you're at fault, your policy may help address The prices for the opposite celebration’s car or truck repairs and health-related charges. In a way, car insurance coverage is sort of a protect safeguarding you from the implications with the unpredictable street.

Homeowners’ insurance plan is another very important sort of protection, particularly when you individual your own dwelling. This coverage guards your residence from a range of hazards, together with hearth, theft, or all-natural disasters like floods or earthquakes. With no it, you can facial area money damage if your property were being wrecked or severely ruined. Homeowners’ insurance not merely covers repairs, but also provides liability safety if somebody is wounded on the house. It is a comprehensive basic safety Web for your house and every little thing in it.

Lifestyle insurance plan is one spot That always gets ignored, but it surely’s just as critical. Even though it’s not one thing we want to consider, daily life insurance policy ensures that your loved ones are fiscally protected if a little something were being to happen to you. It offers a payout in your beneficiaries, encouraging them deal with funeral bills, debts, or living expenditures. Existence insurance policies is usually a means of exhibiting your loved ones that you choose to care, even after you're gone.

Yet another form of insurance security that’s getting progressively popular is renters’ insurance plan. When you hire your house or condominium, your landlord’s insurance may possibly include the building alone, but Discover the facts it really gained’t include your individual belongings. Renters’ insurance policies is comparatively economical and may shield your possessions in case of theft, hearth, or other sudden events. It’s a small expenditure that can help you save from important economical loss.

When we’re on the topic of insurance coverage, Allow’s not ignore disability insurance policy. It’s on the list of lesser-known types of protection, however it’s incredibly vital. Disability insurance supplies cash flow replacement if you develop into not able to operate as a consequence of disease or personal injury. It makes sure that you don’t drop your livelihood if some thing unexpected transpires, allowing for you to definitely deal with Restoration without having stressing regarding your funds. For individuals who depend on their paycheck to help make ends meet, disability insurance plan is usually a lifesaver.

Now, Enable’s speak about the value of selecting the right insurance plan company. With a great number of alternatives out there, it could be too much to handle to pick the ideal one particular for yourself. When deciding on an insurance provider, you want to make certain they offer the protection you need at a rate you are able to manage. It’s also crucial to take into consideration their name, customer care, and the convenience of filing statements. In fact, you desire an insurance company Visit website that will likely have your back again any time you have to have it most.

But just possessing insurance coverage protection isn’t ample. You also will need to know the terms of your respective coverage. Examining the great print may not be enjoyment, nonetheless it’s vital to know exactly what’s included and what isn’t. You should definitely realize the deductibles, exclusions, and limits of your respective protection. By doing so, it is possible to keep away from unpleasant surprises when you should file a assert. Understanding is power when it comes to insurance policies.

How Insurance Risk Solutions can Save You Time, Stress, and Money.

One more component to think about will be the probable for bundling your insurance plan guidelines. Numerous insurance policies businesses present discounts if you purchase many types of insurance by them, which include home and vehicle protection. Bundling can save you funds even though making sure that you've got thorough safety in position. So, should you’re now looking for 1 sort of insurance plan, it would be well worth Checking out your options for bundling.The idea of insurance plan security goes outside of personalized insurance policies also. Companies have to have insurance policy also. When you very own a company, you very likely face challenges that may effects your business’s fiscal wellbeing. Organization insurance plan guards you from A variety of issues, such as assets destruction, legal liabilities, and personnel-related dangers. Such as, normal legal responsibility insurance plan may also help shield your online business if a client is injured on your premises. Possessing organization insurance gives you the security to work your business without continuously stressing about what could go wrong.

Little Known Questions About Insurance Pricing Solutions.

As essential as it is actually to obtain the appropriate insurance plan coverage, it's equally important to critique your guidelines often. Lifestyle changes, and so do your insurance coverage demands. When you’ve just lately had a baby, acquired a household, or improved Employment, your present insurance policies may possibly no longer be sufficient. By reviewing your insurance plan safety annually, you be certain that you’re constantly sufficiently coated in your current conditions. It’s a proactive stage to safeguard your long run.

Talking of long run, insurance coverage protection will also be portion of one's prolonged-expression financial See details system. Though it’s principally about covering hazards, particular forms of coverage, like lifestyle coverage, might also serve as an investment. For illustration, some existence insurance plan guidelines have a dollars benefit ingredient that grows over time. Because of this in addition to offering defense in your family members, these guidelines could also work as a personal savings vehicle for your long term.

The bottom line is the fact that insurance coverage defense is much more than simply a money basic safety Web – it’s peace of mind. It’s realizing that, regardless of the transpires, you've got a cushion to tumble back on. Regardless of whether it’s well being insurance coverage, automobile coverage, or home insurance policies, these guidelines be sure that you’re not dealing with life’s issues by yourself. With the appropriate insurance policy protection in position, you'll be able to give attention to living your lifetime towards the fullest, figuring out that you choose to’re covered once the unanticipated takes place.

Lastly, don’t ignore the necessity of being educated concerning the evolving planet of insurance policy. As new threats emerge and regulations transform, your insurance needs may perhaps shift. Trying to keep by yourself educated on the most up-to-date tendencies and updates can help you make the most effective alternatives for your individual or business enterprise security. All things considered, In regards to insurance coverage, know-how seriously is electricity. So, make the effort To guage your options and be sure you’re getting the defense you'll need. Your upcoming self will thank you!

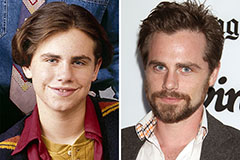

Rider Strong Then & Now!

Rider Strong Then & Now! Bradley Pierce Then & Now!

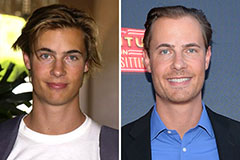

Bradley Pierce Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!